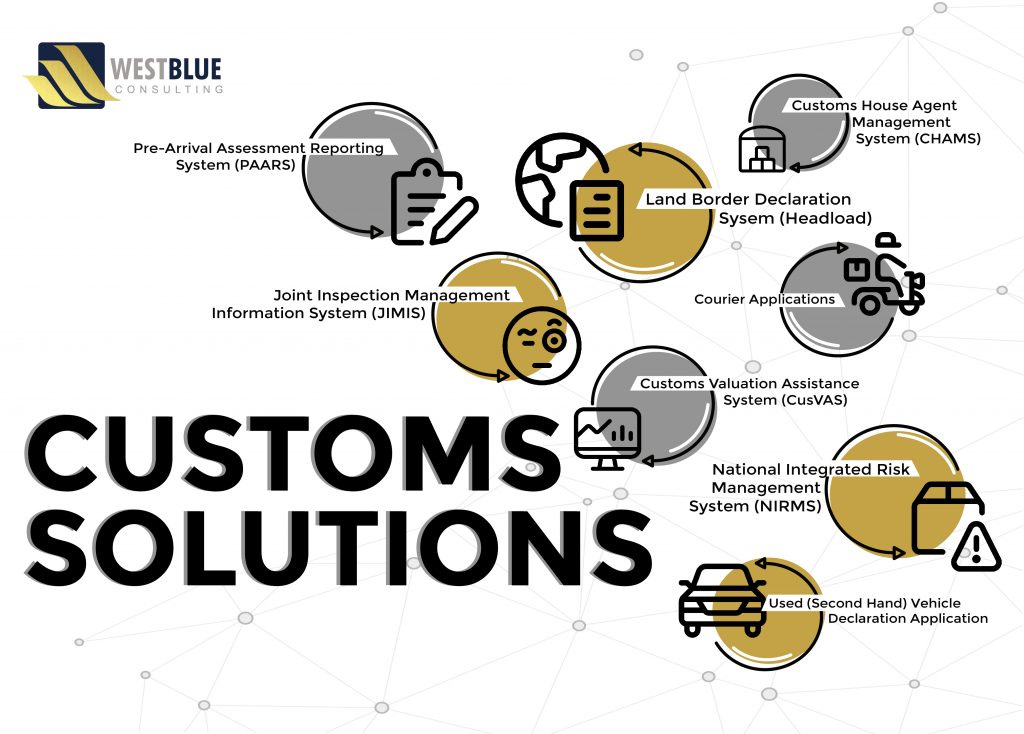

CUSTOMS SOLUTIONS

Faced with high levels of fraud in goods valuation, invoice manipulation, tariff classification and dishonest tax reporting, customs and tax administrations experience numerous challenges in the execution of their mission to secure revenue, prevent capital flight and tax fraud, and facilitate legitimate trade.

In order to increase revenues, protect national interests, and ensure supply chain security, customs administrations must simplify the clearance process and reduce unnecessary delays to trade promotion while keeping the level of compliance under control.

Our tailored suite of customs solutions automates the entire customs clearance process. Our system is designed to support WCO and WTO trade facilitation initiatives, including advance ruling, authorized economic operator, pre-arrival processing, risk management, post clearance audit, single window, expedited shipments, appeal request and electronic payment.

Pre-Arrival Assessment Report System (PAARS)

PAARS is a self-declaration system which allow traders to submit electronic import declaration data with the digital copy of trade documents to customs authorities through a secured online platform prior to the arrival of the goods in the destination country.

This enables customs authorities to assess any associated risk with the declaration and determine the amount of duty and taxes to be paid, an addition to any intervention required with the consignment on arrival.

Customs Valuation Assistance System (CusVAS)

Our Valuation solution is an intelligent decision support and assessment tool used by customs administrations to assess potential risk regarding the veracity and accuracy of the declared customs value of imported goods. The valuation application combines several databases to build an integrated consolidated valuation tool which is regularly updated to enable customs authorities to have access to accurate data reflecting the transaction value and other related historical information from previously imported goods.

A colour indicator alerts customs if there is a discrepancy between the declared value and the customs value of the goods, which could point to underlying risk. This enables customs to make well-informed decisions on valuation and classification of imported goods and to prevent loss of revenue due to under valuation or mis-declaration.

Joint Inspection Management Information System (JIMIS)

JIMIS provides an interface between the customs, terminal operators, regulatory and security agencies for the management of physical examination processes, leading to expedited clearance of goods and decongestion of the ports. JIMIS sends advanced notification to the agency(s) involved in the examination process, granting them access to the declaration and supporting documentation in advance.

National Integrated Risk Management System (NIRMS)

NIRMS is an intelligence-enabled and automated risk management application that provides a single, unified system to identify, assess, manage, and mitigate risks before a consignment arrives in destination country. The application expedites the release of low-risk goods using an econometric multi-regression model and artificial intelligence algorithm. NIRMS helps customs and government security agencies to develop process architecture that strengthens coordination and collaboration across risk, compliance, assurance and port functions thus enabling the system to deal with ever fluctuating and evolving non-compliance patterns.

Customs House Agent Management System (CHAMS)

CHAMS is a one-stop portal for Customs House Agents and customs brokers to register and renew their operational licenses through a secure online portal. The system allows the user to register at their convenience and submit their information immediately, eliminating the need of filling paper forms manually and submitting them to a registration office. The approval process is fast and seamless. Furthermore, the application sends notifications to the agents informing them about their expiration date of their license.

Courier Application

The Courier Application is a user-friendly, end-to-end application which expedites the processing of all courier declarations at the airport. The application streamlines customs clearance by allowing courier companies, postal agencies and customs to exchange advanced import data and calculate required duties and taxes. The smart valuation tool, intelligent tariff classification and robust risk assessment functions assist customs to collect revenue effectively and efficiently. The system is integrated with an e-Payment functionality enabling the parcel owner to pay for duty and taxes at their convenience.

Land Border Declaration System (Headload)

The Headload Application is an end-to-end application which expedites the processing of low value goods declarations at the land border. The smart valuation tool, intelligent tariff classification and robust risk assessment functions assist customs to collect revenue effectively and efficiently.

Used (Second Hand) Vehicle Declaration Application

The Used Vehicle Declaration application is a robust solution that assists customs to decode any vehicle whether from North America, Europe or Asia in order to obtain necessary vehicle information including vehicle type, model, make and year of manufacture. The application uses the vehicle identification number (VIN) or chassis number to determine the appropriate duty and taxes to be paid in the destination country.